Real Estate Market Cycles help investors decide not just which property to buy — but when. By understanding the phases of the market — boom, stabilization, decline, recovery — and watching economic indicators, you can time purchases and sales for maximum return. In India, where cycles are often uneven and shaped by policy, interest rates, infrastructure and sentiment, timing can make a big difference.

Recent data shows that in many Indian cities, property prices tend to rise 8–15% annually during boom periods, but stagnate or even correct 2–5% during slowdown phases. That swing can make or break investment returns for those who buy or sell at the wrong time.

If you’re an investor looking to build or exit a real-estate portfolio, knowing how to read the cycle — when to strike and when to wait — can turn good deals into great ones. This article explores exactly how to do that in a structured, data-backed way.

Understanding Real Estate Market Cycles: Boom, Stabilization, Decline & Recovery

Real estate doesn’t move in a straight upward line. Instead, it goes through roughly four phases:

- Boom: strong demand, rising prices, aggressive investment, high liquidity.

- Stabilization: growth slows, prices steady, risk / reward recalibrates.

- Decline: oversupply or demand dip causes price stagnation or fall, lower transaction volume.

- Recovery: market bottoms out, economic conditions improve, prices begin rising again.

Each phase offers different opportunities and risks. For investors, the smartest moves can come from buying in recovery/stabilization, and selling during a boom.

In India’s context — where supply lags infrastructure growth and demand is often concentrated — understanding these phases helps avoid buying at peaks or selling at troughs.

How Economic Indicators Help Predict Property Market Trends:

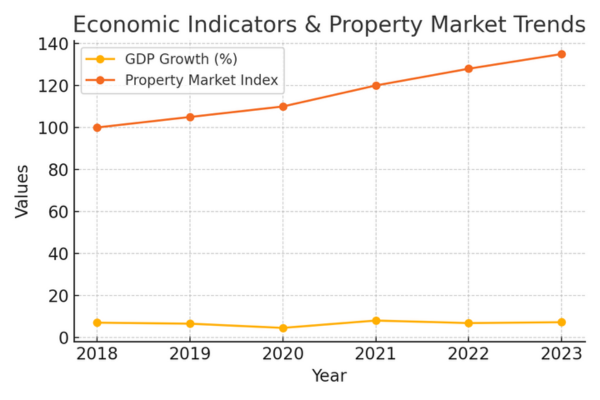

Economic indicators can act as early warning lights. Key signals to watch:

- Interest rates & inflation: Lower interest rates reduce EMI burden, boost demand. High rates increase cost of borrowing and dampen demand.

- Urban migration & job growth: As more people move to cities for work — especially tech, services, manufacturing — rental and demand pressure rises.

- Infrastructure projects & policy news: New metro lines, highways, transport corridors, smart-city initiatives tend to push demand in surrounding neighborhoods.

- Supply pipeline data: If many new homes are entering the market, there could be oversupply soon — warning against buying at peak.

By monitoring these indicators — through government data, local construction approvals, banking interest rate trends — an investor can anticipate shifts in the cycle before they fully reflect in prices.

Buy Low, Sell High: Identifying Peak and Bottom Cycles in Real Estate

Buying at the bottom or near recovery often offers the best value. Property values are lower, demand is beginning to normalize, and rental yields tend to be higher due to lower acquisition cost.

Selling at peak or during late stage of boom can yield maximum capital gains. Demand is high, prices elevated, and buyers often pay premium for scarcity or momentum.

To identify peaks and bottoms:

- Track average sales volumes — low volume may warn of a slowdown.

- Compare rent-to-price ratio — if rents don’t keep up with prices, long-term yield may suffer.

- Watch interest rate moves — a rising rate environment often signals coming slowdown.

Best Time to Buy Property: Recovery and Stabilization Phases Explained

Recovery Phase — when property prices begin to stabilize after a slump, and demand slowly returns. Pros: lower entry cost, less competition, potential for appreciation as confidence returns.

Stabilization Phase — when price growth has leveled but hasn’t surged yet. Pros: moderate price, lower risk, good rental yield if demand exists.

For long-term investors seeking rental income or wait-for-appreciation strategy, these phases tend to offer the best risk-to-reward balance.

Expert Tips for Building a High-Yield Rental Property Portfolio in India

Best Time to Sell Property: Recognizing the Boom Cycle for Maximum Profit

Boom cycles — characterized by high demand, rising prices, scarce supply — are ideal for selling. Buyers are often willing to pay a premium for immediate possession, scarcity, or perceived future demand.

During boom, capital gains are maximized. Rental demand is high, vacancy low. If you’re looking for profit, exit during early- to mid-boom before prices plateau or oversupply begins to build.

Seasonal Real Estate Trends in India: What Months Offer Price Advantage?

Unlike stock markets, real estate sees seasonal demand spikes around certain times:

- Festive season & year-end (Oct–Dec) — sentiment is high, many families prefer shifting before new year.

- Post-budget announcement periods — policy clarity can boost demand.

- Monsoon season (Jun–Aug) — usually slower; sellers may offer discounts.

Buying during off-peak or slower seasons can mean better deals; selling during high-demand windows can yield premiums.

How Interest Rate Changes Impact Buying and Selling Decisions:

Interest rates directly affect affordability. When rates drop:

- Loan EMIs decrease → more buyers qualify → demand increases → prices rise.

When rates rise:

- Financing becomes expensive → demand shrinks → price growth slows or corrects.

Investors who buy when rates are low and sentiment is stable tend to get better long-term value; those who commit during rate hikes risk overpaying or facing negative cash flow.

External Factors Affecting Real Estate Cycles: Policies & Infrastructure

Real-estate cycles in India are strongly influenced by external shocks or interventions:

- New government policies (taxation, lending rules, regulation)

- Infrastructure launches (metro, highways, airports)

- Global economic conditions (which affect foreign investment, developer liquidity)

- Regulatory changes — RERA, GST, building codes

Any of these can shift a market from boom to slowdown or vice versa — sometimes abruptly. As an investor, staying updated on policy and infrastructure developments helps anticipate those shifts.

Using Data and Market Research Tools to Time Real Estate Investments:

Data can remove much of the guesswork. Useful resources:

- Government or municipal databases for building approvals, project registrations, infrastructure permits.

- Local real-estate aggregator portals showing price trends, units listed vs sold, time-on-market.

- Interest-rate trackers and banking loan demand data.

- Demographic migration and employment data from labour surveys and job-portal analytics.

By gathering and analysing this data over time — instead of relying on anecdotal evidence — you can spot early signs of boom or decline and make informed buy/sell decisions.

Investor Psychology and Market Sentiment: How Emotions Drive Buying Decisions

Real estate often seems stable — but sentiment plays a big role. When everyone’s buying, prices go up quickly; when cautious, even good properties wait unsold.

Common investor mistakes:

- Buying during hype (peak) driven by fear of missing out

- Holding during decline out of emotional attachment

- Ignoring underlying supply data

Successful investors stay disciplined: they buy when data shows value, and sell when fundamentals and sentiment align — not when hype peaks.

FAQs — Best Time to Buy or Sell Property

Q1: Can I time the market perfectly?

👉No. Markets are unpredictable. But using cycles, economic indicators and data — you can improve odds and reduce risk.

Q2: How long should I hold property to time a cycle?

👉At least 5–7 years, to ride through at least one full cycle (recovery → boom → stabilization).

Q3: Does this apply to residential and commercial both?

👉Yes. Both follow cycles, but their triggers differ (commercial: business demand; residential: housing demand).

Conclusion:

Understanding Real Estate Market Cycles gives property investors a powerful tool — not a crystal ball, but a framework. By watching economic indicators, supply pipelines, interest rates, and infrastructure developments — and combining that with data-driven research — you can improve timing, maximize returns, and minimize risk.

If you’re investing today or planning your next move, the key question remains: are you ready to ride the next cycle at the right time?