Book value is one of the most fundamental metrics in financial analysis, especially when evaluating a company’s worth in the stock market. It serves as a critical indicator of a company’s actual value, stripped of market hype or investor sentiment. Whether you’re a seasoned investor or a beginner, understanding book value can help you make more informed decisions about where and how to invest your money.

It reflects a company’s net worth, while the PE ratio measures price relative to earnings. Together, they help investors evaluate whether a stock is undervalued or overvalued.

Table of Contents

What Is Book Value?

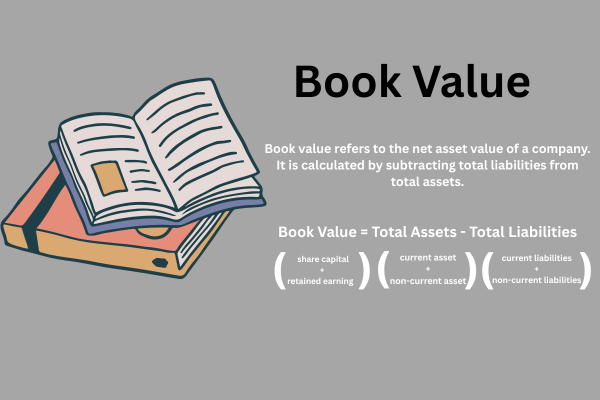

Book value refers to the net asset value of a company, calculated by subtracting total liabilities from total assets. In simpler terms, it’s what would remain for shareholders if a company were to liquidate its assets and pay off all its debts. It represents the company’s intrinsic value based on its financial statements.

Formula:

Book Value = Total Assets - Total Liabilities

For Example,

Total Assets = ₹50,00,000

Total Liabilities = ₹30,00,000

Book Value = ₹50,00,000 – ₹30,00,000

Book Value = ₹20,00,000 (book value of this company)

This number is usually found on a company’s balance sheet and is often expressed on a per-share basis as Book Value Per Share (BVPS):

BVPS = (Total Assets - Total Liabilities) / Total Outstanding Shares

For Example,

Book Value = Total Assets - Total Liabilities = ₹20,00,000 (Above Mentioned)

BVPS = (Total Assets - Total Liabilities) / Total Outstanding Shares

= ₹20,00,000 / 1,00,000

= ₹20Why Is Book Value Important?

1) Measures a Company’s True Net Worth

It represents the actual net asset value of a company, offering a realistic view of what shareholders would receive if the company were liquidated.

2) Helps Identify Undervalued Stocks

Investors often compare a stock’s market price with its net worth to spot value-buying opportunities.

3) Foundation for Key Financial Ratios

It’s essential in calculating ratios like the Price-to-Book (P/B) ratio and Return on Equity (ROE), which help assess valuation and profitability.

4) Reliable During Market Volatility

While stock prices fluctuate due to sentiment, this metric offers a more stable and objective benchmark.

5) Relevant for Asset-Heavy Sectors

Industries such as real estate, banking, and manufacturing rely on net asset value due to their significant physical holdings.

6) Shows Long-Term Financial Strength

A consistently rising figure over time suggests retained earnings, effective management, and growing shareholder equity.

7) Enhances Credibility in Analysis

Analysts trust this measure as a reliable part of fundamental research for long-term investments.

8) Useful in Bankruptcy Scenarios

It helps estimate recoverable value for shareholders if the company faces liquidation.

9) Supports Long-Term Strategies

Value investors often track its trend to assess intrinsic worth and potential returns.

Book Value vs. Market Value

- Book Value: Based on historical cost accounting; it reflects tangible assets and liabilities.

- Market Value: Based on current stock price multiplied by outstanding shares; includes market expectations and sentiment.

A significant difference between the two can indicate whether a stock is overpriced or underpriced.

Components Included

- Tangible Assets: Machinery, buildings, land, equipment.

- Current Assets: Cash, inventory, receivables.

- Liabilities: Debts, loans, accounts payable.

Note: Intangible assets like patents and goodwill are usually excluded to maintain conservative estimates.

How to Calculate Book Value: Step-by-Step

Step 1: Gather Financial Statements

Download the company’s most recent balance sheet from its annual report or financial website.

Step 2: Identify Total Assets

This includes both current and non-current (fixed) assets.

Step 3: Identify Total Liabilities

Sum all short-term and long-term liabilities.

Step 4: Use the Formula

Subtract total liabilities from total assets.

Step 5: Calculate BVPS (Optional)

Divide the book value by the number of outstanding shares.

Book Value in Stock Analysis

It is commonly used alongside other metrics like:

- Price-to-Book (P/B) Ratio:

P/B Ratio = Market Price per Share / Book Value per Share - A P/B ratio under 1 is often considered undervalued.

- Return on Equity (ROE):

ROE = Net Income / Book Value - It Indicates how efficiently a company uses its equity base to generate profit.

Book Value vs Intrinsic Value

While book value focuses on the balance sheet, intrinsic value is more holistic and includes projected earnings, future cash flows, and growth potential. Investors often compare both to make balanced decisions.

When to Use Book Value

- When analyzing asset-heavy industries like manufacturing, banking, and utilities.

- For evaluating undervalued stocks.

- During economic downturns where tangible asset backing provides safety.

Understanding the concept of a company’s net worth is essential for making informed investment decisions. By analyzing a firm’s total assets and liabilities, investors can gain a clearer picture of its financial health and long-term potential. Whether you’re evaluating undervalued stocks or comparing similar companies, this approach offers a solid foundation for analysis. While not the only metric to rely on, book value plays a vital role in understanding a company’s true worth beyond market speculation. When combined with other financial ratios, it becomes a powerful tool in your investment strategy.

Frequently Asked Questions (FAQs)

Q1: What is intangible asset?

An intangible asset is a non-physical asset with economic value, such as patents, trademarks, copyrights, goodwill, or brand recognition, contributing to a company’s long-term success and competitive advantage.

Q2: What is tangible asset?

A tangible asset is a physical item of value owned by a company or individual. Examples include machinery, buildings, land, vehicles, and inventory.

Q3: What are current and non-current assets?

Current assets are short-term assets like cash, inventory, and receivables expected to be used or converted into cash within a year. Non-current assets are long-term investments like property, equipment, or patents held for more than a year.

Q4: What are current and non-current liabilities?

Current liabilities are short-term financial obligations like accounts payable and short-term loans due within a year. Non-current liabilities are long-term debts or obligations, such as bonds payable or long-term leases, due after one year or more.

Q5: What are asset-heavy industries?

Asset-heavy industries are sectors that require significant investment in physical assets like machinery, buildings, or infrastructure. Examples include manufacturing, real estate, utilities, transportation, and oil and gas industries.

Q6: What are asset-light industries?

Asset-light industries rely less on physical assets and more on intellectual property, services, or technology. Examples include software companies, consulting firms, digital platforms, and financial services, offering scalability with lower capital investment.