Cryptocurrency trading and investing have grown from a niche interest into a global financial trend, attracting everyone from first-time investors to experienced traders. But while the profit potential can be exciting, the crypto market is also highly volatile — meaning success depends on knowledge, discipline, and the right strategies. Rather than relying on hype or guesswork, smart investors focus on proven methods such as risk management, portfolio diversification, technical and fundamental analysis, and long-term planning.

Understanding market behavior, protecting your capital, and staying emotionally disciplined can make all the difference between consistent growth and costly mistakes. In this guide, we’ll break down the top strategies for successful cryptocurrency trading and investing, so you can build confidence, reduce risk, and make smarter financial decisions in the crypto world. Whether you’re just starting out or looking to refine your approach, these insights will help you trade and invest more effectively.

Understanding Market Cycles: Bull Runs, Bear Phases, and Accumulation Periods

One of the first lessons veteran crypto investors internalize is that markets move in cycles. Unlike traditional stocks, cryptocurrency markets are heavily influenced by investor sentiment, macro events, and liquidity flows, leading to patterns of rapid expansion (bull runs), contraction (bear markets), and periods of sideways accumulation. In general, crypto market cycles tend to last several years, often peaking around major events such as Bitcoin’s halving schedule or shifts in institutional demand.

Bull markets can produce dramatic returns; past cycles have seen double-digit or even triple-digit percentage gains for major assets. In contrast, bear markets compress prices for extended periods, testing investor discipline. Recognizing where the market currently stands — whether in accumulation, distribution, or decline — helps traders time entries and exits with better context.

Actionable Tip: Study historical price action for major coins and note how broader markets reacted during previous cycles. Patience and cycle awareness can help investors avoid emotional decisions.

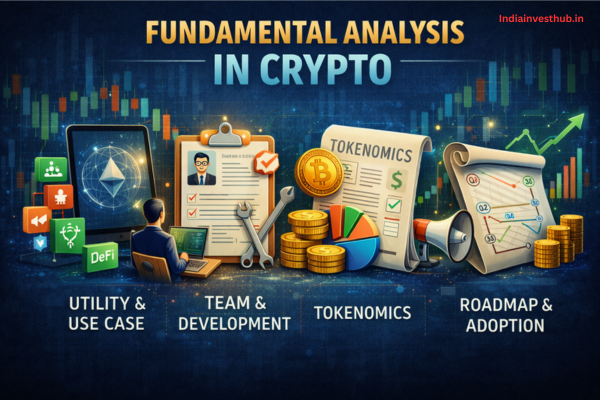

Fundamental Analysis in Crypto: How to Evaluate a Coin Before Investing

In traditional investing, fundamental analysis gauges company value by earnings, cash flows, and business prospects. In crypto, fundamentals look different but serve a similar purpose: assessing the strength and potential of a project.

Key crypto fundamentals include:

- Use case and adoption: Is the token solving real problems?

- Network activity: Growing users, transactions, or developers signal relevance.

- Tokenomics: Supply structure, inflation schedules, and governance can impact long-term value.

- Partnerships and backing: Institutional interest or foundational support can influence confidence.

For example, Bitcoin’s narrative as digital gold and a hedge against inflation has strengthened institutional interest, while smart contract platforms have gained traction as foundational infrastructure for decentralized applications.

Before allocating capital, investors should also consider project documentation (whitepapers), community engagement, and developer activity.

Technical Analysis Basics: Reading Charts, Indicators, and Price Patterns

Technical analysis (TA) is arguably one of the most widely used tools by crypto traders. Unlike fundamental analysis — which evaluates long-term value — TA focuses on price action and trends to identify opportunities over shorter horizons.

Core elements of TA include:

- Support and resistance levels: Identifying price floors and ceilings where markets often reverse or stall.

- Trend lines and moving averages: Commonly used to determine direction and momentum.

- Indicators: Tools like Relative Strength Index (RSI) or MACD help gauge overbought or oversold conditions.

- Volume analysis: Confirming whether price moves are backed by real trading activity.

Because cryptocurrency markets trade 24/7 and can be fragmented across exchanges, technical patterns may form more frequently than in traditional markets. Investors often combine TA with market cycle awareness to make high-confidence entry and exit decisions.

Risk Management Strategies: Protecting Capital in a Volatile Market

While strategies can generate profits, managing risk keeps traders alive through drawdowns and downturns. Crypto volatility is well documented: markets can swing 10-20% in a single session. Without safeguards, accumulated profits can evaporate quickly.

Common risk management methods include:

- Position sizing: Avoiding overexposure by limiting the size of each trade relative to total capital.

- Stop-loss orders: Setting automatic exits if prices move against a position beyond a predefined threshold.

- Risk-reward analysis: Only entering trades with favorable expected return relative to potential loss.

- Diversification: Allocating investments across multiple cryptocurrencies and even other asset classes.

By preserving capital first, investors ensure they have the liquidity to seize opportunities when the market shifts.

Long-Term Investing vs Short-Term Trading: Which Strategy Fits Your Goals?

Cryptocurrency trading and investing are not interchangeable. Long-term investors typically buy and hold positions based on future value expectations, while short-term traders seek profits from daily or weekly price fluctuations.

Long-term investing can simplify many challenges by eliminating the stress of short-term volatility. Historically, major assets have shown growth over multi-year horizons despite interim declines. In contrast, short-term trading requires constant attention, quick reaction times, and a strong grasp of technical signals.

Many investors adopt a hybrid approach, allocating a core portion to long-term holdings while reserving a portion for strategic trades.

Diversification Done Right: Building a Balanced Crypto Portfolio

Diversification is not merely buying multiple coins — it’s about selecting assets that behave differently under various market conditions. A diversified crypto portfolio may include:

- Blue-chip assets: Well-established digital assets with high liquidity.

- Utility tokens: Platforms with real-world or on-chain usage.

- Stablecoins: Pegged assets that can provide capital stability and yield through lending or staking.

Diversification helps reduce the impact of any single asset’s poor performance on the overall portfolio. For example, diversification across assets with different use cases can mitigate volatility and improve long-term risk profile.

Staking, Yield Farming, and Passive Income Opportunities in Crypto:

Beyond trading profits, many investors seek passive income structures. Staking — locking assets in proof-of-stake networks — can generate regular rewards. Yield farming in decentralized finance (DeFi) platforms lets users earn returns by providing liquidity or lending assets.

These strategies offer a way to compound gains over time, but they come with risks like smart contract bugs or temporary loss. Investors must thoroughly research protocols and understand terms before participating.

Avoiding Scams and Rug Pulls: Red Flags Every Crypto Investor Should Know

The crypto space has unfortunately attracted bad actors due to its decentralized and unsupervised nature. Common red flags include:

- Anonymous teams without verifiable credentials

- Promises of guaranteed returns

- Liquidity locked only by developers

- Poorly written or plagiarized whitepapers

Avoiding these traps requires vigilance and skepticism. Investors should verify project legitimacy through community feedback, audits, and transparency.

Tax Planning and Legal Compliance for Cryptocurrency Investors:

Regulatory environments around the world are evolving rapidly. For example, new frameworks now require crypto platforms to share account details for tax purposes, forcing investors to report gains or losses accurately.

Understanding applicable local laws and reporting obligations helps avoid fines and maximizes net after-tax returns. Many investors work with financial advisors specializing in digital assets for compliance and strategic planning.

Developing a Winning Mindset: Emotional Discipline and Trading Psychology

Perhaps the least technical but most impactful strategy is mastering psychology. Fear and greed can cloud judgment at both market tops and bottoms. Emotional discipline helps investors stick to their plan without succumbing to panic selling or FOMO buying.

Investors who succeed over time often share traits like patience, diligence, and a willingness to learn from mistakes rather than react impulsively.

FAQs — Cryptocurrency Trading and Investing

Q1: What’s the difference between trading and investing in crypto?

👉Trading focuses on short-term price moves, while investing is about long-term value growth.

Q2: Should beginners use technical analysis?

👉Yes, but start with basics — chart patterns and moving averages — before exploring advanced indicators.

Q3: Does diversification reduce risk?

👉Yes, spreading assets across different cryptocurrencies and strategies reduces asset-specific risk.

Q4: Is crypto tax owed on every trade?

👉In many jurisdictions, selling crypto for profit is a taxable event, so tracking gains and losses is essential.

Q5: Can passive income reduce portfolio risk?

👉Passive yields from staking or lending add return streams but should complement — not replace — core strategies.

Conclusion:

Successful cryptocurrency trading and investing aren’t about chasing quick profits — they’re about building a smart, disciplined approach that balances opportunity with risk. By understanding market cycles, using solid analysis, diversifying wisely, protecting your capital, and keeping emotions in check, you can navigate the crypto market with far more confidence. Remember, no strategy guarantees success, but consistent learning and thoughtful decision-making can significantly improve your long-term results. As the crypto landscape continues to evolve, staying informed and adaptable will always be your biggest advantage.

So, which of these strategies will you start applying to your cryptocurrency journey today?