Understanding the psychology behind support and resistance in financial markets is crucial for both novice and experienced traders. These concepts go beyond mere technical analysis tools; they reflect the collective behavior and emotional responses of market participants. The Psychology Behind Support and Resistance in Financial Markets can offer insight into why prices behave in certain ways at these levels and how this can impact trading strategies. In this article, we’ll explore the underlying psychological forces that drive price action at support and resistance levels, and how traders can use this understanding to make more informed decisions.

Table of Contents

What Are Support and Resistance?

Before diving into the psychology behind support and resistance, it is essential to understand what these terms mean in the context of financial markets.

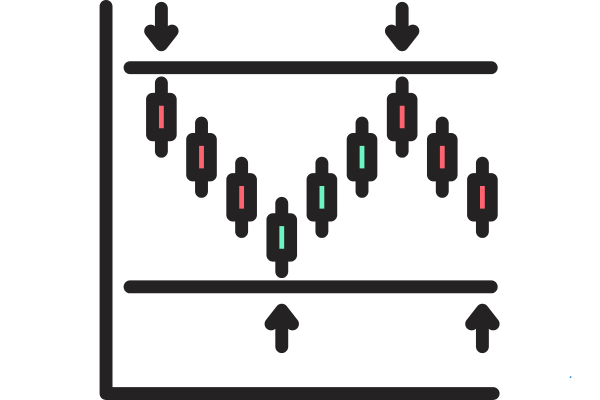

- Support: A price level where a downtrend can be expected to pause or reverse due to a concentration of demand.

- Resistance: A price level where a trend is likely to pause or reverse due to a concentration of selling interest.

Traders watch these levels closely as they are key indicators of potential trend reversals or continuation. These levels are not static and can change depending on market conditions, making them dynamic areas to watch.

The Psychological Foundation of Support and Resistance

To truly grasp The Psychology Behind Support and Resistance in Financial Markets, one must delve into the psychology of the traders themselves. The prices at support and resistance levels represent collective beliefs about value, fear, and greed, which ultimately shape market sentiment.

The Role of Fear and Greed

The emotional drivers behind price movements are often rooted in two powerful emotions: fear and greed. At support levels, buyers are motivated by fear of missing out (FOMO) or the belief that prices have reached a low point, triggering demand. Conversely, at resistance levels, sellers are motivated by fear of a price drop or the belief that the market has reached its peak, which leads to selling pressure. These opposing emotional forces are continuously in play, creating price fluctuations.

Behavioral Finance and Market Sentiment

Behavioral finance, a field that studies the psychological influences on investor behavior, plays a key role in understanding The Psychology Behind Support and Resistance in Financial Markets. It posits that investors are often irrational, influenced by cognitive biases and emotions rather than purely objective analysis. For example:

- Anchoring Bias: Traders may anchor to a particular price level as an important reference point, impacting their decisions about support or resistance.

- Herd Mentality: The behavior of other traders can influence an individual’s decision to buy at support or sell at resistance. This social influence can strengthen the psychological impact of these levels.

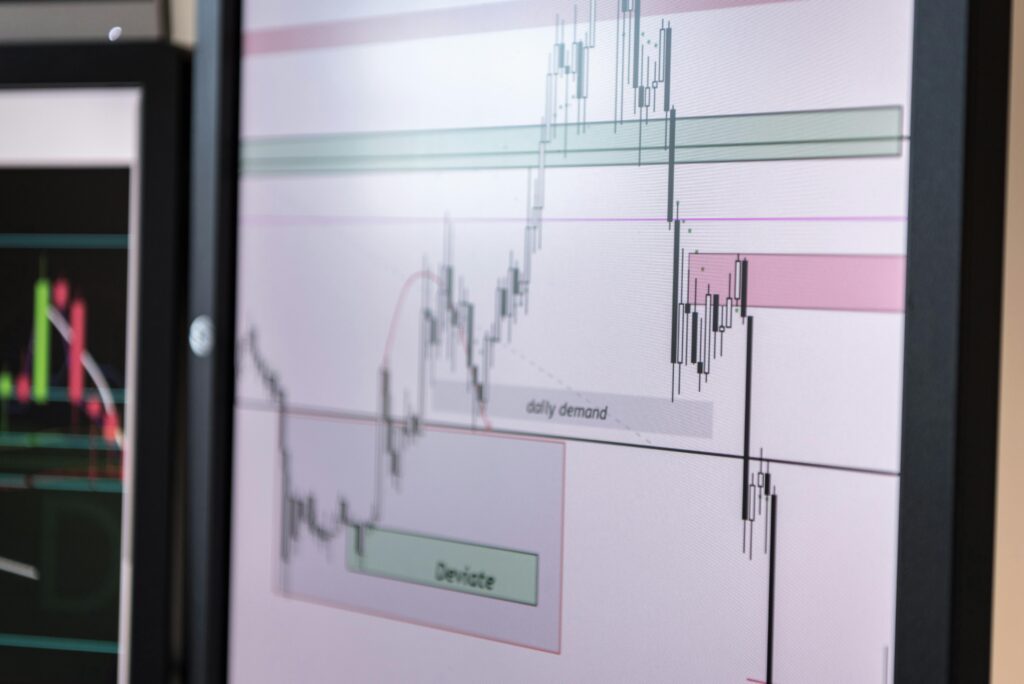

As traders crowd around key support and resistance levels, these areas become self-fulfilling prophecies, with many entering and exiting the market at these points, reinforcing the price behavior.

Why Do Prices Bounce at Support and Resistance?

The core psychological idea behind support and resistance is the concept of market memory. When prices approach a certain level, traders remember the previous reactions at that point, influencing their current decisions. This is where the idea of “market memory” comes into play, as traders psychologically “expect” certain outcomes based on historical price action.

At support levels, buyers are stepping in because they expect the price to rise again, either because they believe it is undervalued or because past price action has shown this level to hold. Similarly, at resistance, traders may expect the price to drop again because previous attempts to break through that level failed.

The Impact of Market Psychology on Price Breakouts

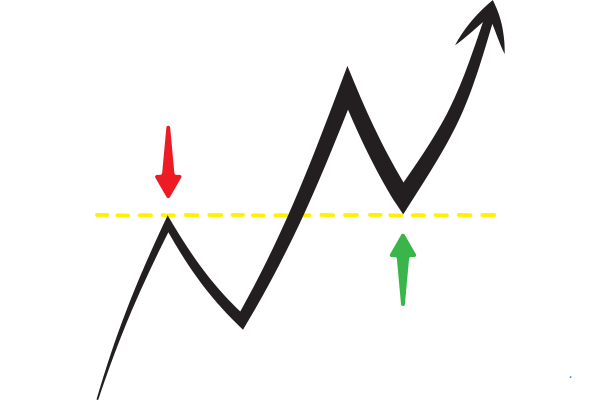

One of the most crucial aspects of The Psychology Behind Support and Resistance in Financial Markets is understanding how breakouts occur. A breakout happens when the price moves through a previously established support or resistance level.

Traders often view breakouts as significant opportunities for profit. The psychology behind breakouts is driven by momentum trading—when market participants perceive a breakout as a confirmation of a new trend. This leads to a surge of buying or selling, which can cause prices to move rapidly in one direction. However, breakouts are not always guaranteed to be successful. Sometimes they lead to a false breakout, where prices quickly reverse. The psychology behind false breakouts is also important—traders may enter prematurely or get caught up in the momentum, only to see the price reverse back to its previous levels.

The Role of Confirmation in Trading Decisions

The Psychology Behind Support and Resistance in Financial Markets also involves confirmation. Traders often wait for confirmation before acting on a support or resistance level. For example, a break below support or a move above resistance may trigger buy or sell orders, depending on whether the price has closed above or below the level in question.

This confirmation aspect is also psychologically significant. Traders often hesitate to act until they see evidence that supports their hypothesis, reflecting a desire to avoid making mistakes or suffering losses. This cautious approach can lead to more precise trading decisions, but it can also cause traders to miss out on significant price movements.

Psychological Factors That Lead to False Breakouts

While many traders rely on support and resistance to guide their decisions, there are instances when the price moves through these levels but then reverses quickly. These are called false breakouts. The psychology behind false breakouts often revolves around the following concepts:

- Trap Setups: Market makers or institutional traders may push the price beyond a key level, creating a sense of momentum to lure in retail traders. Once these traders commit, the market makers reverse the price, creating losses for the uninformed traders.

- Overconfidence Bias: Traders may become overly confident in their analysis of support or resistance levels and act too quickly, believing they have found the perfect trade setup. This can lead to buying at the wrong time or getting caught in a false breakout.

How to Use Psychological Insights in Trading

To be successful, traders must learn to manage the psychological aspects of trading. Understanding The Psychology Behind Support and Resistance in Financial Markets allows traders to use this information more effectively.

- Stay Patient and Disciplined: Understanding that the market is driven by emotion helps traders develop patience. Do not rush into trades based on impulse or fear of missing out.

- Avoid Herd Mentality: While it’s easy to get caught up in the momentum of the crowd, true success comes from being able to think independently. Use support and resistance levels as guides, but also assess the broader market context.

- Use Multiple Indicators: Support and resistance are powerful tools, but they should not be the only factor in decision-making. Combine these levels with other technical indicators to improve the accuracy of your trades.

- Control Emotions: Emotions like greed, fear, and overconfidence can cloud judgment. By understanding how these feelings affect market decisions, traders can better control their impulses and make more rational decisions.

From Charts to Profits: A Beginner’s Guide to Technical Analysis emphasizes understanding price patterns and indicators. Recognizing The Psychology Behind Support and Resistance in Financial Markets helps traders predict market behavior and enhance decision-making.

The Psychology Behind Support and Resistance in Financial Markets plays a crucial role in shaping price movements and trading decisions. These levels are not just arbitrary; they represent collective trader behavior driven by fear, greed, and market sentiment. Understanding this psychology helps traders anticipate potential reversals, breakouts, or consolidations with greater confidence.

Support levels often indicate areas where buying pressure is strong enough to halt a downtrend, reflecting traders’ belief in undervaluation. Similarly, resistance zones highlight areas where selling pressure dominates, reflecting overvaluation concerns. The Psychology Behind Support and Resistance in Financial Markets stems from these repeated behaviors, making these levels self-fulfilling and highly effective for technical analysis.