Improving your credit score quickly and maintaining it over the long term is one of the smartest financial moves you can make. A strong credit score not only increases your chances of loan approval but also helps you secure lower interest rates on credit cards, personal loans, car loans, and home loans. Many people think credit scores take years to improve, but with the right strategy, you can see noticeable progress in a few months while building habits that protect your score for life.

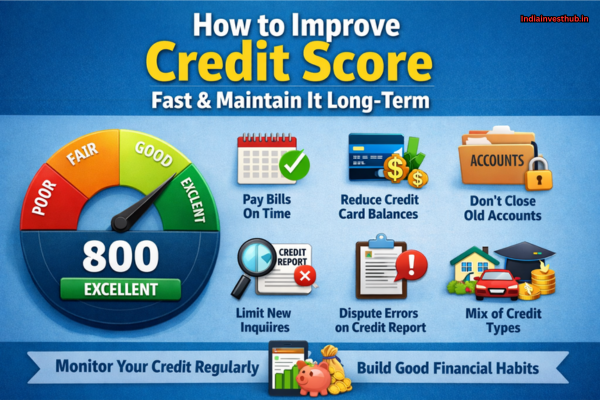

Credit score improvement is not about shortcuts or tricks — it’s about understanding how lenders evaluate you and making consistent, smart financial decisions. Simple actions like paying bills on time, reducing credit utilization, avoiding unnecessary loan applications, and monitoring your credit report can create a powerful positive impact. At the same time, long-term maintenance requires discipline, planning, and responsible credit usage.

In this guide, you’ll learn practical, easy-to-follow methods to improve your credit score fast and maintain it steadily over time. Whether you are planning to apply for a loan soon or just want to build a strong financial future, these strategies will help you stay on the right track.

Check Your Credit Report Regularly and Fix Errors:

Credit Score improvement should always start with reviewing your credit report. Many investors assume their score is low because of past mistakes, but sometimes errors in the report itself reduce the score.

Industry studies from global credit bureaus suggest nearly 15–20% of credit reports may contain minor inaccuracies. Some common errors include:

- Incorrect loan closure status

- Duplicate loan entries

- Incorrect outstanding balance

- Wrong personal identity mapping

Regular credit monitoring helps detect these early. Once corrected, score improvements can happen relatively quickly.

Pay Credit Card Bills and EMIs on Time:

Credit Score depends heavily on repayment history. Payment behavior is often the largest component of score calculation.

According to Experian credit analytics models, repayment history contributes around 35%–40% of total score weightage. Even one missed payment can negatively impact credit score for months.

Simple habits help:

- Enable auto debit

- Set payment reminders

- Maintain emergency liquidity for EMIs

Consistent repayment builds long-term lender confidence.

Credit Card Hacks: Maximizing Rewards and Minimizing Risk

Reduce Credit Utilization Ratio Below 30%:

Credit Score improves when lenders see controlled credit usage. High utilization suggests financial pressure.

Example:

If total credit limit = ₹2,00,000

Ideal usage = below ₹60,000

Keeping utilization low signals financial discipline. Many investors mistakenly believe full limit usage shows strong eligibility, but it actually increases perceived risk.

Avoid Multiple Loan and Credit Card Applications:

Credit Score temporarily decreases when lenders check credit reports for loan approval. Too many enquiries signal aggressive borrowing behavior.

Instead:

- Research loan options first

- Shortlist lenders

- Apply only where chances are strong

Spacing applications protects score stability.

Apply for Credit Card Online

Clear Outstanding Dues and Overdue Payments First:

Credit Score recovery becomes difficult if overdue balances remain unpaid.

Priority action plan:

- Pay overdue EMIs

- Clear credit card minimum dues immediately

- Negotiate settlement for old defaults if necessary

According to credit bureau recovery data, clearing overdue dues is often the fastest way to stabilize credit profile.

Maintain a Healthy Credit Mix (Loans and Credit Cards):

Credit Score reflects borrowing maturity. Investors who handle multiple credit types responsibly often score higher.

Healthy mix includes:

- Secured loans (home, car)

- Unsecured credit (cards, personal loans)

Balanced mix shows financial management ability across risk categories.

Do Not Close Old Credit Cards with Good History:

Credit Score benefits from longer credit history. Older credit cards show repayment discipline over time.

Closing old accounts reduces average credit age. Instead:

- Keep oldest card active

- Use occasionally

- Pay fully on time

This supports score stability.

Use Credit Cards Responsibly for Long-Term Score Growth:

Credit Score strengthens when credit cards are used wisely.

Best practices:

- Pay full bill, not minimum due

- Avoid frequent cash withdrawals

- Maintain consistent monthly usage pattern

Responsible credit usage creates positive long-term score trends.

Build Credit Score from Scratch (No Credit History Tips):

Credit Score can be built even if you have never taken credit before.

Options include:

- Secured credit cards

- Small consumer loans

- Entry-level credit cards

Starting small helps build lender confidence gradually.

How Long Does It Take to Improve Credit Score? Real Timeline

Credit Score improvement speed depends on past credit damage and current discipline.

Typical ranges:

- 1–2 Weeks:

Small improvements possible after clearing overdue payments or correcting credit report errors. - 1–3 Months:

Noticeable credit score increase if you start paying EMIs and credit card bills on time consistently. - 3–6 Months:

Moderate improvement happens when credit utilization is reduced below 30% and no new late payments occur. - 6–12 Months:

Significant recovery possible if past defaults are cleared and strong repayment history is maintained. - 12+ Months:

Long-term stability and strong credit score achieved with disciplined credit usage and no missed payments.

Consistent positive credit behavior always gives results.

FAQs – Improve Credit Score Fast

Q1: Can credit score increase quickly?

👉Small improvements can happen fast with correct actions.

Q2: Does checking credit score reduce it?

👉No, personal checks do not reduce score.

Q3: Is high salary equal to high credit score?

👉No. Repayment behavior matters more.

Q4: Can credit score drop without loans?

👉Yes, if credit cards are mismanaged.

Q5: Is credit score permanent?

👉No, it keeps changing based on financial activity.

Q6: How can I get loan approval faster?

👉Maintain stable income, keep documents ready, reduce existing debt, and apply with a reliable repayment history.

Q7: Does paying EMIs on time help in future loan approvals?

👉Yes, consistent repayment history improves lender confidence and increases chances of future approvals.

Q8: Is it good to apply for multiple loans at the same time?

👉No, multiple applications at once can make lenders think you are financially stressed.

Q9: Does closing old credit cards help financial profile?

👉Not always. Old accounts with good history help show long-term financial discipline.

Q10: Can I get a loan without past borrowing history?

👉Yes, but you may start with smaller loan amounts or secured credit options.

Q11: How often should I review my financial credit report?

👉At least once or twice a year to check for errors and monitor financial health.

Conclusion:

In conclusion, improving your credit score fast and maintaining it long-term is all about consistency, awareness, and smart financial habits. There is no magic solution, but by paying your bills on time, keeping your credit utilization low, avoiding unnecessary loan applications, and regularly checking your credit report, you can build a strong and stable credit profile. Small financial decisions made daily can create a big impact over time, helping you qualify for better loan offers, lower interest rates, and greater financial flexibility.

Remember, a good credit score is not just about getting loans — it reflects your financial discipline and reliability. By staying patient and following the right strategies, you can not only improve your score quickly but also protect it for years to come, giving you peace of mind and stronger financial opportunities in the future.

Are you ready to start taking control of your credit score today and build a stronger financial future for yourself?