Applying for a car loan offline is a preferred choice for many buyers who want personal guidance and face-to-face interaction with bank officials or dealership executives. Even today, visiting a bank branch or car showroom helps borrowers clearly understand loan terms, interest rates, and repayment options before making a decision. Offline car loan applications are especially useful for people who are not comfortable with online processes or have unique financial situations.

When you apply for a car loan offline, the lender verifies your documents, explains eligibility criteria, and assists you throughout the approval process. You also get the chance to negotiate interest rates, choose suitable loan tenure, and clarify doubts related to EMIs, processing fees, and insurance. While the process may take slightly longer than online applications, it offers a more personalized experience.

In this step-by-step guide, you’ll learn how to apply for a car loan offline, where to apply, the documents required, eligibility conditions, and tips to get faster approval at a lower interest rate. This guide will help you confidently apply for a car loan offline and make an informed borrowing decision.

Table of Contents

Eligibility Criteria for Applying a Car Loan Offline:

Car Loan eligibility rules remain mostly the same whether you apply online or offline, but offline applications allow more flexibility in explanation and negotiation.

Banks and NBFCs usually check:

- Age: Typically between 21 and 65 years

- Income: Minimum monthly or annual income as per lender norms

- Employment type: Salaried or self-employed

- Credit score: Higher score improves approval and interest rate

- Job or business stability: Longer stability increases trust

Offline applications are particularly helpful for investors with fluctuating income, commission-based earnings, or business income, as branch staff can review documents more carefully instead of relying only on automated systems.

Apply for a Car Loan Online: Step-by-Step Guide

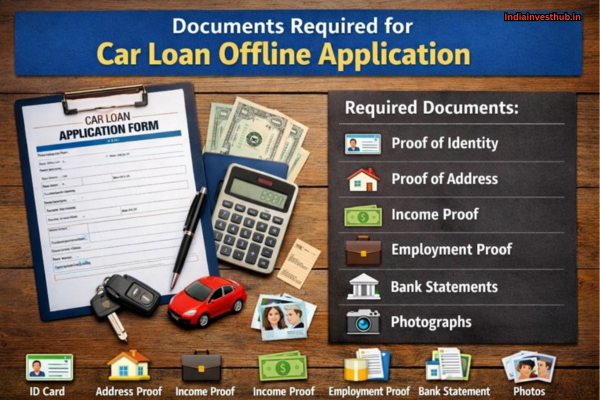

Documents Required for Car Loan Offline Application:

Car Loan offline applications involve physical document submission, so preparation matters.

Commonly required documents include:

- Identity proof (Aadhaar, PAN, passport, driving licence)

- Address proof (utility bill, Aadhaar, passport)

- Income proof (salary slips, bank statements, ITR)

- Employment proof or business proof

- Recent photographs

- Car quotation or proforma invoice

Submitting complete and accurate documents at once helps reduce delays in approval.

Step-by-Step Process to Apply for a Car Loan Offline:

Car Loan offline applications follow a structured process.

- Visit the Bank or NBFC Branch

Walk into a nearby bank, NBFC office, or authorized car dealership. - Discuss Loan Requirements

Speak with the loan officer about loan amount, tenure, interest rate, and EMI options. - Check Eligibility Manually

The executive reviews your income, credit score, and employment details. - Submit Application Form

Fill out the car loan application form carefully. - Submit Physical Documents

Provide photocopies and originals for verification. - Verification Process

Bank may conduct residence, employment, or telephonic verification. - Loan Approval

Approval is granted after credit and document checks. - Loan Disbursal

Loan amount is paid directly to the car dealer or seller.

Offline applications may take longer but offer clarity at each step.

Where to Apply for a Car Loan Offline (Bank, NBFC, Dealership):

Car Loan offline applications can be made at different places.

Banks:

- Lower interest rates

- Strong regulatory trust

- Slightly longer approval time

NBFCs:

- Faster approvals

- Flexible eligibility

- Slightly higher interest rates

Car Dealerships:

- One-stop solution for car + loan

- Quick processing

- Interest rates may be higher due to tie-ups

Investors often prefer banks for cost savings and NBFCs for speed and flexibility.

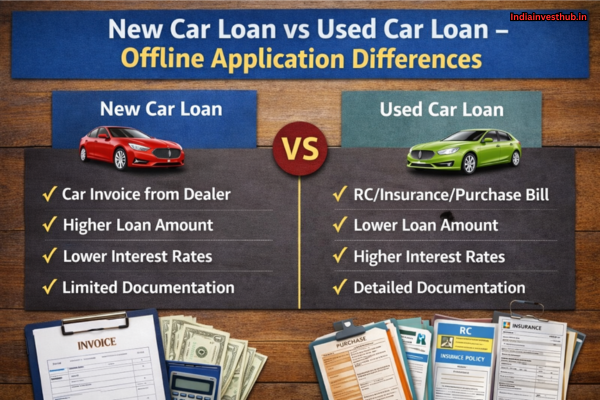

New Car Loan vs Used Car Loan – Offline Application Differences:

Car Loan terms differ significantly for new and used cars.

New car loans usually:

- Have lower interest rates

- Offer higher loan-to-value ratio

- Allow longer tenures (up to 7 years)

Used car loans usually:

- Carry higher interest rates

- Require higher down payment

- Offer shorter tenure (up to 5 years)

Offline applications are commonly preferred for used car loans due to manual valuation and negotiation.

Car Loan Interest Rates Offered by Banks in Offline Mode:

Car Loan interest rates offered offline are similar to online rates but sometimes negotiable.

As per RBI and bank disclosures, car loan interest rates generally range from:

- 8%–10% for new cars

- 11%–16% for used cars

Offline discussions allow:

- Rate negotiation for high-credit borrowers

- Special schemes for salaried professionals

- Festival or dealership offers

Investors with strong profiles may secure better rates offline.

How Car Loan EMI Is Calculated in Offline Applications:

Car Loan EMI calculation follows the same formula online and offline.

EMI depends on:

- Loan amount

- Interest rate

- Loan tenure

Example:

Loan amount: ₹8,00,000

Interest rate: 9.5%

Tenure: 5 years

Monthly EMI ≈ ₹16,800

Offline loan officers often show EMI charts and repayment schedules to help borrowers choose the best tenure.

Car Loan Approval Process and Time Taken Offline:

Car Loan approval time offline is slightly longer than online.

Typical timeline:

- Document submission: Same day

- Verification: 2–5 working days

- Approval: 3–7 working days

- Disbursal: 1–3 working days

According to bank lending data, offline approvals usually take 5–10 working days, depending on verification complexity.

Common Mistakes to Avoid While Applying for Car Loan Offline:

Car Loan rejections or delays often happen due to avoidable errors:

- Incomplete documents

- Incorrect income declaration

- Ignoring credit score issues

- Choosing EMI beyond affordability

- Not comparing lenders

Being transparent and prepared avoids most problems.

Tips to Get Faster Approval and Lower Interest Rate Offline:

Car Loan approval can be improved by:

- Carrying complete documents

- Maintaining good credit score

- Applying with a co-applicant

- Negotiating interest rate at branch

- Choosing shorter tenure if affordable

Offline negotiation often helps reduce processing fees and interest margins.

FAQs – Car Loan:

Q1: Is offline car loan still relevant?

👉Yes, especially for used cars and non-standard income profiles.

Q2: Can I negotiate interest rate offline?

👉Yes, negotiation is more flexible offline.

Q3: Is offline approval safer than online?

👉Both are safe, but offline offers personal clarity.

Q4: Do offline loans take longer?

👉Yes, slightly longer than online loans.

Q5: Is dealership loan better than bank loan?

👉Dealership loans are faster but may cost more.

Conclusion:

Car Loan offline applications remain a strong choice for investors and buyers who value personal interaction, flexibility, and negotiation. While online loans are faster, offline loans offer clarity, trust, and customization—especially for used cars, self-employed borrowers, and complex financial profiles. By understanding eligibility, documents, interest rates, EMI calculation, approval timelines, and negotiation tips, you can make smarter decisions and avoid costly mistakes.

Before choosing your loan path, ask yourself—do you value speed more, or is personal guidance and better negotiation worth the extra time when applying for a car loan offline?