High-Yield Bonds: Opportunities and Risks offer investors the potential for higher returns compared to investment-grade bonds. These bonds are issued by companies with lower credit ratings, meaning they carry a higher risk of default. However, the increased risk comes with the opportunity for greater yields, making them attractive to investors seeking higher income. Understanding High-Yield Bonds: Opportunities and Risks is essential for balancing potential returns with associated risks. Factors such as market conditions, credit ratings, and interest rate fluctuations can significantly impact their performance. Proper diversification and thorough research can help investors capitalize on the benefits while managing the risks effectively.

Table of Contents

What Are High-Yield Bonds

High-yield bonds are bonds that offer higher interest rates because they are issued by companies or entities with lower credit ratings. These bonds are also known as junk bonds because they carry a higher risk of default compared to investment-grade bonds. To compensate for this risk, issuers provide higher yields to attract investors. High-yield bonds are rated below BBB by credit rating agencies like Standard & Poor’s and Moody’s. While they offer the potential for greater returns, they are more sensitive to market volatility, economic downturns, and changes in interest rates, making them a riskier but potentially rewarding investment option.

Why Companies Issue High-Yield Bonds

Companies may issue high-yield bonds for several reasons, including funding new projects, refinancing existing debt, or expanding operations. Firms with weaker credit profiles or those undergoing financial restructuring often resort to high-yield bonds as a means to raise capital when other financing options are limited.

Opportunities with High-Yield Bonds

High Income Potential

One of the primary attractions of high-yield bonds is the potential for higher income. The interest rates on these bonds are significantly higher than those offered by investment-grade bonds, providing investors with better yields and the opportunity for increased cash flow.

Diversification

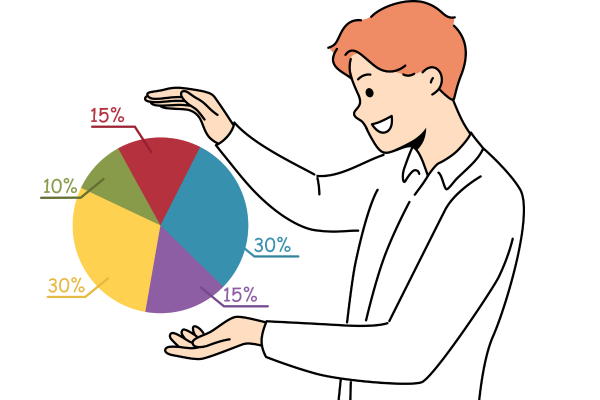

High-yield bonds can add diversification to an investment portfolio. Their performance often differs from that of traditional fixed-income securities, such as government bonds or investment-grade corporate bonds, and they may react differently to economic changes. This diversification can help manage overall portfolio risk.

Capital Appreciation

In addition to earning interest, high-yield bond investors may benefit from capital appreciation. If the issuing company’s financial condition improves and its credit rating is upgraded, the bond’s price may increase, allowing investors to sell at a profit.

Inflation Hedge

High-yield bonds can serve as an inflation hedge. Since these bonds offer higher yields, they can help investors maintain purchasing power in an inflationary environment better than lower-yielding bonds.

Evaluating High-Yield Bonds

Credit Analysis

When evaluating High-Yield Bonds: Opportunities and Risks, credit analysis plays a crucial role in understanding the issuer’s financial health. High-yield bonds are issued by companies with lower credit ratings, making them riskier but potentially more rewarding. Analyzing the issuer’s balance sheet, cash flow, and debt levels helps investors assess whether the company can meet its financial obligations. Proper credit analysis reduces the chances of default and enhances investment returns from High-Yield Bonds: Opportunities and Risks

Bond Ratings

Bond ratings, provided by agencies like Moody’s and S&P, reflect the creditworthiness of an issuer. High-yield bonds are typically rated below investment grade (BB+ or lower). A lower rating indicates higher risk but also higher potential returns. Understanding the rating scale helps investors balance risk and reward when considering High-Yield Bonds: Opportunities and Risks. Monitoring rating changes over time helps in making informed investment decisions.

Yield Spreads

Yield spreads measure the difference between the yield of a high-yield bond and a risk-free government bond. A wider spread indicates higher perceived risk, while a narrowing spread suggests improving credit conditions. Evaluating yield spreads helps investors identify market trends and select high-yield bonds with attractive returns. Yield spreads are a key factor in assessing High-Yield Bonds: Opportunities and Risks.

Diversification

Diversification reduces risk by spreading investments across different issuers, industries, and geographies. Investing in a mix of high-yield bonds lowers the impact of a single default on the overall portfolio. Diversification ensures a balanced approach to managing High-Yield Bonds: Opportunities and Risks while enhancing potential returns.

Strategies for Investing in High-Yield Bonds

Individual Bonds vs. Funds

Investors can choose to invest in individual high-yield bonds or high-yield bond funds. Individual bonds offer more control over specific holdings, while bond funds provide diversification and professional management.

Laddering

Laddering is a strategy that involves purchasing bonds with staggered maturities. This approach can help manage interest rate risk and provide a steady stream of income as bonds mature at different intervals.

Active Management

Actively managing a high-yield bond portfolio involves regularly reviewing and adjusting holdings based on changes in credit ratings, market conditions, and economic trends. This strategy can help capitalize on opportunities and mitigate risks.

High-Yield Bond ETFs

Exchange-traded funds (ETFs) that focus on high-yield bonds offer a convenient way to gain exposure to a diversified portfolio of high-yield bonds. ETFs trade on stock exchanges, providing liquidity and flexibility.

Investing in High-Yield Bonds: Opportunities and Risks requires a strategic approach to balance potential returns with associated risks. Strategies like choosing between individual bonds vs. funds allow investors to tailor their portfolios based on risk tolerance and income goals. Laddering helps manage interest rate fluctuations by spreading investments across various maturities. Active management allows fund managers to adjust holdings based on market conditions, while high-yield bond ETFs offer diversified exposure with liquidity and cost efficiency. By understanding these strategies, investors can maximize returns while mitigating risks associated with High-Yield Bonds: Opportunities and Risks. Careful planning and professional guidance are essential for success.

Frequently Asked Questions (FAQs)

1) Is it good to buy bonds when yields are high?

Yes, buying bonds when yields are high can be beneficial as you secure higher interest payments, increasing your overall returns. However, it’s important to assess credit risk and market conditions before investing.

2) What is the time period of a bond?

The time period of a bond refers to the duration from the bond’s issuance to its maturity date, which can range from a few months to 30 years or more.