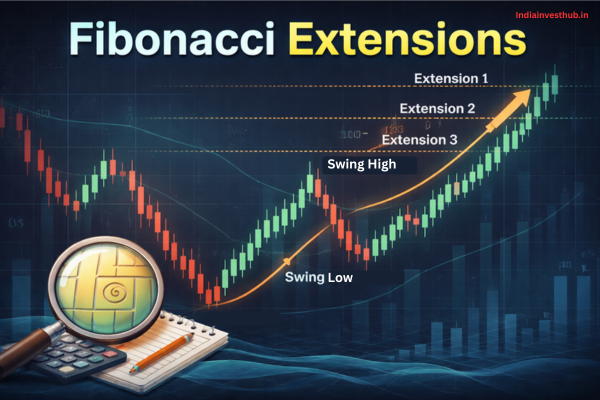

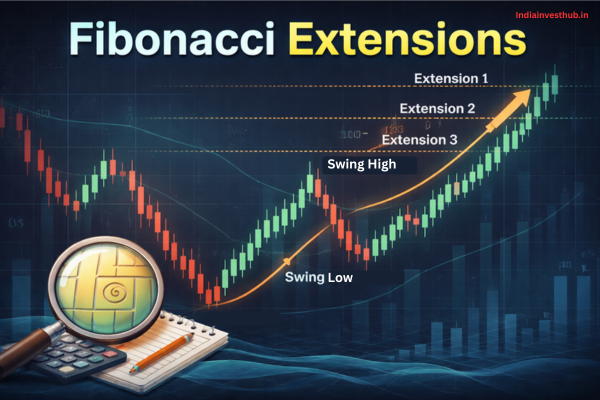

Fibonacci Extensions Explained: How Traders Predict Profit Targets and Manage Risk

The Importance of Fibonacci Extensions in Risk Management

The Importance of Fibonacci Extensions in Risk Management

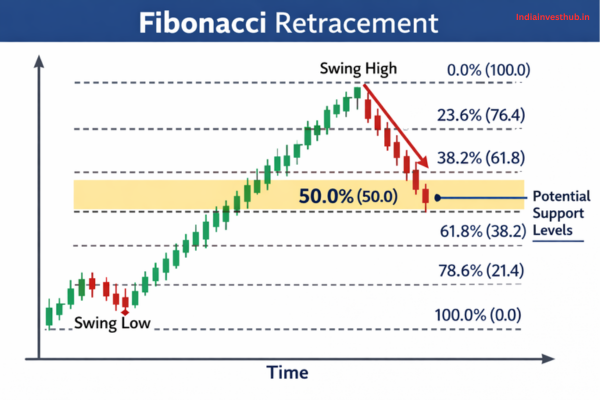

Fibonacci retracement is one of the most popular tools in technical trading — and for good reason. Traders across the world rely on Fibonacci levels to spot potential pullbacks, plan entries, and manage risk before the next big price move. Whether you trade stocks, forex, crypto, or commodities, Fibonacci retracement can help you identify where…

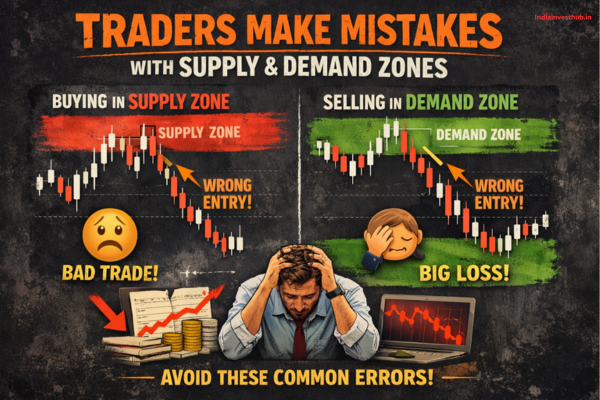

Supply and demand zones are one of the most powerful tools in technical trading—but they’re also one of the most misunderstood. Many traders learn the concept, mark a few zones on the chart, and expect price to react perfectly. When that doesn’t happen, they either abandon the strategy or blame the market. In reality, the…

Support and resistance are some of the most talked-about ideas in trading, yet many investors use them without truly understanding why they work. Prices seem to pause, reverse, or accelerate around certain levels again and again, and this behavior isn’t random. It’s driven by human emotions, shared memories, and collective decision-making in the market. Fear…

Stock volume and liquidity quietly influence every trade you place, even when you don’t consciously think about them. A stock may look attractive on a chart, but if there aren’t enough buyers and sellers, entering or exiting that trade can quickly become costly. Many investors learn this the hard way—through missed exits, unexpected slippage, or…

Short Selling often sounds intimidating to investors, especially those who are used to the simple idea of buying low and selling high. Yet, in real markets, prices don’t always move upward, and some investors actively look for ways to benefit when stocks fall. Short selling exists precisely for those moments. It allows investors to potentially…

DIIs are reshaping the way India’s financial ecosystem functions, and their growing significance in the Indian stock market is undeniable. Imagine a scenario: in March 2020, when the COVID-19 pandemic shook global markets, Foreign Institutional Investors (FIIs) pulled out nearly ₹61,973 crore from Indian equities in a single month. Panic loomed large. Yet, amidst this…

Foreign Institutional Investors (FIIs) have long been the elephants in the room of emerging markets, and nowhere is this truer than in India. Imagine this: In March 2020, as global markets panicked over COVID-19, FIIs pulled out nearly ₹62,000 crore from Indian equities in just one month (source: NSE data). The result? The Nifty 50…

Insider Trading is one of those terms that gets thrown around in financial discussions, but for many investors it’s not clear what it really means or how it affects their portfolios. At its core, insider trading involves buying or selling a company’s stock or other securities based on information that hasn’t been shared with the…

Stock Buybacks are a financial tool companies use more than ever before — and they matter a lot if you’re an investor trying to figure out where your returns come from. In 2024, U.S. corporations returned $1.6 trillion to shareholders, and about 60% of that was through stock buybacks rather than dividends, underlining how central…