Cryptocurrency volatility can be both exciting and overwhelming, especially for investors who are trying to protect their capital while still chasing growth. Prices in the crypto market can rise or fall by double-digit percentages within hours, driven by news events, market sentiment, and speculation — making risk management absolutely essential. Successful investors don’t simply try to predict every price move; instead, they build strategies that help them stay disciplined, minimize losses, and survive sharp market swings. From setting realistic position sizes to using tools like stop-loss orders, diversification, and dollar-cost averaging, the right approach can turn volatility from a threat into an opportunity.

In this guide, we’ll break down practical, easy-to-apply tips to help you navigate unpredictable crypto markets with more confidence and control. Whether you’re a beginner or a seasoned investor, understanding how to manage risk is the key to long-term success in cryptocurrency investing.

Why Cryptocurrency Is So Volatile: Key Market Drivers Explained

Most investors who have experienced a 10%, 20%, or 40% drop — sometimes within days — know volatility isn’t random. Several underlying forces drive these price swings:

- Market liquidity: Cryptocurrency markets are smaller than traditional equity or forex markets. Lower liquidity means large orders can move prices significantly.

- Speculative sentiment: Retail investors often trade based on news or hype, amplifying rapid movements.

- Macro influences: Interest rate changes, regulatory announcements, and global economic shifts can trigger knee-jerk reactions across all digital assets.

- Event-driven catalysts: Hard forks, protocol upgrades, or security incidents frequently cause short-term turbulence.

Understanding these forces helps investors interpret price action rationally instead of reacting emotionally.

What Is Cryptocurrency? A Beginner’s Guide to Digital Money and How It Works

Risk Management Basics: How Much of Your Portfolio Should Be in Crypto?

One of the first questions every investor must answer is: How much capital should I allocate to volatile assets like crypto? Traditional financial advice often suggests limiting exposure to high-growth, high-risk assets to a percentage of your overall portfolio that you can afford to lose without jeopardizing financial goals.

For example, many financial advisors recommend allocating between 1% to 5% of a diversified portfolio to high-volatility assets, depending on risk tolerance and time horizon. This range is not a rule but a guideline that helps maintain balance and prevents emotional overexposure.

For investors focused on controlling risk during sharp price swings, maintaining a disciplined allocation strategy ensures short-term drops don’t derail long-term goals.

Setting Stop-Loss and Take-Profit Levels: Protecting Your Downside

Volatility can erupt without warning, but tools like stop-loss and take-profit orders act as automatic safeguards. A stop-loss order exits a position when the price falls to a certain level, limiting losses. A take-profit order closes a position once a target profit threshold is reached, helping secure gains before the market turns.

For example, if you purchase a crypto asset at $100, setting a stop-loss at $85 limits your downside to 15%, while a take-profit at $150 locks in a 50% gain. These levels vary by individual risk tolerance, but the principle remains: proactively defining exit points helps prevent emotional decision-making during market noise.

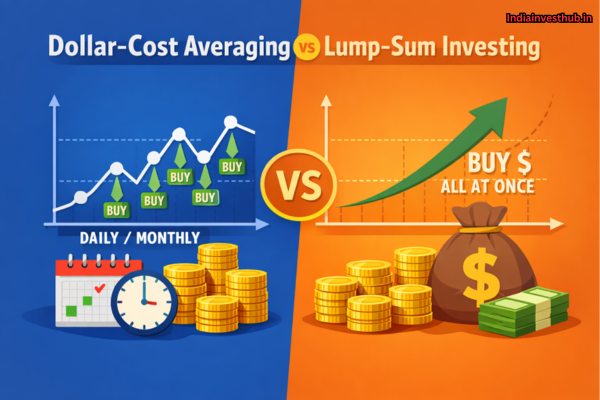

Dollar-Cost Averaging vs Lump-Sum Investing: Which Strategy Reduces Risk?

For investors intimidated by timing the market, dollar-cost averaging (DCA) can be a risk-reducing approach. DCA involves investing a fixed amount in an asset at regular intervals regardless of price. Instead of deploying a large sum at once — which may coincide with short-term peaks — DCA smooths entry prices over time.

In contrast, lump-sum investing involves deploying all capital at once, which can yield higher returns in a steadily rising market but also exposes investors to greater downside if prices correct shortly afterward.

While neither approach guarantees profit, DCA helps avoid the emotional stress of market timing and is particularly useful in highly volatile environments like crypto.

Stablecoins as a Safety Net: Reducing Exposure During Market Swings

Stablecoins — cryptocurrencies pegged to fiat currencies such as USD — provide a valuable tool for managing volatility. When prices start swinging wildly, investors can move capital into stablecoins, reducing exposure to sharp declines while staying positioned for re-entry.

In periods of intense market volatility, the combined stablecoin supply has grown substantially. At times, stablecoin market capitalization has exceeded $150 billion, indicating strong demand for stability within the crypto ecosystem.

Using stablecoins during turbulent periods lets investors retain liquidity and avoid panic selling — a common cause of long-term losses.

Emotional Discipline: Avoiding Panic Selling and FOMO Buying

One of the most overlooked aspects of risk management is psychological discipline. Human emotions — fear and greed — shape market behavior and fuel volatility. When prices plunge, panic selling can turn modest corrections into steep losses. Conversely, fear of missing out (FOMO) during rapid rallies can push investors to chase highs and enter at unfavorable levels.

Keeping a rational mindset requires setting predefined plans for capital deployment, loss limits, and profit targets — and sticking to them even when market chat rooms and social media amplify emotional noise. Veteran investors often say that successful investing is more about controlling emotions than predicting prices.

Hedging Strategies: Using Derivatives and Diversification to Balance Risk

Hedging — taking positions that offset potential losses — is a strategy widely used in traditional finance and increasingly applied in crypto markets. Sophisticated investors may use futures and options contracts to hedge exposure.

For example, if you hold a significant amount of a crypto asset, shorting futures contracts allows you to offset potential losses during downturns. While hedging can be complex and comes with its own costs, it offers a structured way to protect portfolios.

Diversification also functions as a hedge. Instead of allocating all capital to a single coin, spreading investments across different crypto assets — including stablecoins, utility tokens, and even blockchain platform tokens — reduces concentration risk. Diversification may not eliminate losses in market crashes, but it lowers the probability of total portfolio erosion.

Research-First Investing: How Fundamentals Help You Stay Grounded in Volatile Markets

Short-term price charts often look chaotic, but long-term value usually relates to network fundamentals. For cryptocurrencies, fundamentals may include adoption rates, active user metrics, developer activity, protocol upgrades, and real-world usage.

Conducting thorough research helps separate emotional noise from evidence-based signals. Locating credible data sources, reviewing whitepapers, tracking on-chain metrics, and following developer communities can provide context for why certain assets may have resilient value.

Investors who base decisions on fundamentals tend to navigate volatility with greater clarity than those who react solely to short-term price action.

Security and Safeguards: Protecting Funds During Market Chaos

Market volatility often coincides with periods of heightened security risk. During sharp price moves, phishing attacks, exit scams, and platform outages tend to spike as bad actors exploit fear and urgency.

Investors should implement robust security practices:

- Use hardware wallets for long-term storage

- Enable two-factor authentication (2FA) on exchange accounts

- Avoid storing large sums on custodial platforms

- Beware of unsolicited messages and fake websites

Protecting your crypto holdings isn’t just about risk management — it’s about safeguarding your financial future.

Building a Long-Term Crypto Strategy: Surviving Volatility and Growing Wealth

While volatility presents challenges, it also creates opportunities. Investors who approach crypto with a long-term strategy — one that integrates risk management tools, emotional discipline, and fundamental research — are better positioned to survive downturns and benefit from growth phases.

A long-term strategy might include:

- Maintaining a diversified portfolio

- Rebalancing periodically

- Allocating a portion of capital to stablecoins

- Reserving dry powder (capital ready for deployment after corrections)

- Monitoring market cycles rather than daily price ticks

This balanced approach recognizes that while volatility can whip prices in all directions, disciplined investors with a strategic plan stand a better chance of capturing long-term gains.

FAQs — Navigate Cryptocurrency Volatility

Q1: What is Cryptocurrency Volatility?

👉Cryptocurrency Volatility refers to how drastically digital asset prices can change in short periods, often driven by market sentiment, liquidity levels, and macroeconomic factors.

Q2: Can volatility be eliminated in crypto investing?

👉No. Volatility is inherent to crypto due to market size, speculative behavior, and evolving regulations, but risk can be managed through strategy.

Q3: Is dollar-cost averaging better than lump-sum investing?

👉Both have advantages; DCA reduces entry timing risk, while lump-sum may benefit from early gains in rising markets.

Q4: How do stablecoins help during market swings?

👉Stablecoins maintain a fixed value, allowing investors to reduce downside exposure while keeping liquidity ready for future opportunities.

Q5: What role does psychology play in trading?

👉Emotional discipline helps investors avoid panic selling and impulsive decisions, which are often detrimental during volatile phases.

Q6: What causes Cryptocurrency Volatility to increase suddenly?

👉Cryptocurrency Volatility often spikes during major news events, regulatory announcements, whale trades, exchange outages, or macro-economic uncertainty. Low liquidity and high speculation also magnify sudden price swings.

Q7: Is Cryptocurrency Volatility higher than stock market volatility?

👉Yes. Cryptocurrency Volatility is usually much higher than traditional stock markets because crypto is still an emerging asset class with smaller market depth, heavier speculation, and fewer institutional stabilizers.

Conclusion:

Understanding Cryptocurrency Volatility and how to navigate it is essential for any investor who wants to manage risk without abandoning the potential rewards of this dynamic asset class. By mastering risk management basics, leveraging tools like stablecoins and stop-loss orders, practicing disciplined research, and protecting capital through smart diversification and security safeguards, investors can face volatility with confidence rather than fear.

After all, markets will always fluctuate — but the real question is: Are you building the right strategy to thrive through ups and downs?