Mutual fund taxation matters more than ever for investors who want to know “Mutual Fund Taxation: Understanding How Your Investments Are Taxed.” With more than ₹4.17 lakh crore flowing into equity mutual funds in FY 2024-25 alone, according to the Association of Mutual Funds in India (AMFI), it’s clear that mutual funds are a cornerstone of Indian investment portfolios. Yet, many investors remain unsure about how their returns get taxed, whether they’re from equity, debt or hybrid funds.

This article is designed for investors who want to know exactly how mutual fund taxation works — from holding periods to dividend tax rules, from SIPs to ELSS and NRIs. The focus keyword Mutual Fund Taxation appears throughout to ensure clarity and focus.

Types of Mutual Funds and Their Tax Treatment (Equity, Debt, Hybrid):

Understanding different fund types is vital when navigating mutual fund taxation.

- Equity‐oriented mutual funds invest at least 65% of assets in equity shares of domestic companies. For taxation, they follow specific capital gains rules under sections like 111A and 112A of the Income‑tax Act, 1961.

- Debt mutual funds essentially invest in debt and money market instruments. Historically they benefitted from indexation and favourable LTCG rates; however, recent changes have shifted this.

- Hybrid funds (or balanced funds) combine equity and debt. The tax treatment depends on the equity exposure: if > 65% equity, they are treated like equity funds; if not, more like debt funds from a taxation standpoint.

- For example, for investments in debt‐oriented schemes acquired on or after 1 April 2023, all gains are now treated as short-term and taxed at the investor’s income tax slab rate, removing the previous distinction of long-term vs short-term.

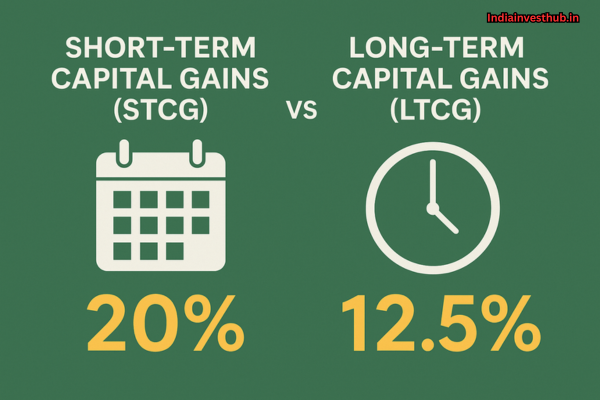

Short-Term Capital Gains (STCG) vs Long-Term Capital Gains (LTCG) Rates:

Key to understanding mutual fund taxation is the distinction between STCG and LTCG and their applicable rates.

- For equity‐oriented funds: STCG (holding up to 12 months) is taxed at 20% from the Budget 2024 announcement. LTCG (holding more than 12 months) is taxed at 12.5% for gains exceeding the exemption limit (₹1.25 lakh per financial year) as per updated rules.

- Before Budget 2024, LTCG on equity funds was 10% for holding over 12 months and STCG at 15%.

- For debt funds: Prior to 1 April 2023, long‐term (held > 36 months) gains were taxed at 20% with indexation benefit. After that date, new investments are taxed as short-term at slab rates, losing the indexation benefit.

- These changes mean investors want to know mutual fund taxation in more depth because shifting rules impact how returns are taxed, especially for funds held for long durations.

How Dividends from Mutual Funds Are Taxed in India:

Mutual fund taxation also covers dividends, and many investors overlook this.

- After the abolition of Dividend Distribution Tax (DDT) in 2020, dividends received by individual investors from mutual funds are now taxable in their hands as “income from other sources”.

- TDS is applicable on dividend income from mutual funds at 10% if paid/credited above ₹5,000 in a financial year.

- For investors keen on tax planning, it is useful to know that even if dividends are reinvested, they still count as taxable income in the year they are declared.

Indexation Benefits on Debt Mutual Funds:

Indexation is a tax planning tool that previously played a big role for debt fund investors.

- Under old rules (for debt funds held > 36 months, purchases before 1 April 2023), indexation allowed for cost-inflation adjustment, thereby reducing taxable gains and taxed at 20% with indexation.

- Post changes, for debt funds purchased after 1 April 2023, gains are treated as short-term and taxed at slab rates without indexation.

- For investors want to know mutual fund taxation: if you have old holdings in debt funds, check the purchase date and holding period carefully before redeeming, since indexation benefit may still apply.

Taxation Rules for SIP Investments (FIFO Method Explained):

Systematic Investment Plans (SIPs) are popular, but they complicate mutual fund taxation.

- In SIPs, each instalment is treated separately for taxation purposes — the holding period is computed for each tranche. So the First-In, First-Out (FIFO) or similar approach matters. For example, if you started SIP in 2019 and have one in 2023, each segment may have different tax treatment.

- Many investors want to know mutual fund taxation around SIPs because even though the aggregate investment is same, the tax liability differs based on entry dates and maturity of each SIP instalment.

- The new rules emphasise that you can’t treat entire SIP as one block for LTCG; each tranche needs tracking.

Systematic Investment Plans (SIP): The Ultimate Guide for Beginners

Taxation of ELSS Funds Under Section 80C:

Tax saving funds have their own special treatment.

- The Equity-Linked Savings Scheme (ELSS) is treated like other equity‐oriented funds for capital gains, but the main benefit for investors is deduction under section 80C of the Income-tax Act up to ₹1.5 lakh per year.

- For mutual fund taxation: While investing in ELSS gives you deduction, the gains on maturity or redemption are taxed like equity funds (i.e., LTCG/STCG rules apply). Therefore, you still need to plan for tax on the exit.

- Investors want to know mutual fund taxation fully: investing with the deduction today is good, but ignoring the eventual tax on exit may reduce net returns.

TDS Rules on Mutual Fund Gains and Dividends:

Understanding withholding tax (TDS) is key to net returns.

- Dividends: As earlier noted, TDS at 10% applies if dividend income from mutual funds exceeds ₹5,000 in a year.

- Capital gains: For resident individuals, there is no TDS on redemption of mutual fund units except in certain cases (e.g., NRIs, non-resident investors). However, for NRIs, higher TDS rates may apply or treaty rates may be applicable.

- Investors want to know mutual fund taxation in full: if you’re an NRI or you hold overseas funds, ensure you understand how TDS applies and whether you can reclaim excess TDS or benefit from tax treaties.

Set-Off and Carry Forward of Capital Losses:

Tax planning around losses is as important as gains.

- Losses from mutual fund redemptions follow the same rules as capital assets: short-term losses can be set off against short-term and long-term gains; long-term losses only against long-term gains. These losses can be carried forward for up to eight assessment years.

- For example, if one tranche of your mutual fund gave a short-term loss, you may offset it against other short-term gains from different funds, reducing your tax liability. Investors who want to know mutual fund taxation should keep detailed records of purchase dates, units redeemed, and holding periods.

- Carry forward requires filing I-T returns within the due date even if no tax is payable otherwise — it’s a common pitfall among investors.

Taxation for NRIs Investing in Indian Mutual Funds:

If you’re a non-resident investor, mutual fund taxation becomes more nuanced.

- For NRIs, taxation is somewhat similar but treaty benefits and higher TDS rates can apply. The definition of “capital asset” and “transfer” in the Income-tax Act may treat sale/redemption differently.

- Additionally, for NRIs, the removal of indexation benefit for specified mutual funds (funds with < 35% equity) purchased on or after 1 April 2023 means potential higher tax burden.

- So for investors who want to know mutual fund taxation when they are NRIs, it’s advisable to check both domestic tax law and the treaty between India and their country of residence for relief or reduced rates.

Best Tax-Saving Strategies for Mutual Fund Investors:

Knowing the rules is one thing; applying them for maximised after-tax returns is another.

- Hold for the long term: For equity funds, since LTCG rate is 12.5% and STCG rate is 20%, holding beyond 12 months improves tax efficiency.

- Check purchase date for debt funds: Investments made before 1 April 2023 may still enjoy LTCG with indexation; post that date, tax rate may be your slab rate. Timing exits matters.

- Use ELSS smartly: Invest maximum allowable under section 80C in ELSS, but treat exit tax as part of return calculation.

- Track SIP instalments: Note each SIP date and its holding period to compute tax accurately.

- Offset gains with losses: Use capital losses to offset gains, carry forward where needed, and file returns on time.

- Plan for NRI status: If you’re an NRI or will become one, understand treaty benefits, TDS rules, and check if funds qualify under “equity‐oriented” or “specified mutual fund” definitions.

- Mind dividend tax: Even if reinvested, dividends are taxable – factor them in.

- Keep records: Capital gains computation requires cost of acquisition, date of purchase, date of redemption, amount redeemed and holding period—essential for accurate tax reporting.

Conclusion:

Mutual fund taxation in India is evolving, with recent shifts making it more important for investors to know exactly how their returns will be taxed. Whether you’re investing in equity, debt, hybrid or tax-savings funds (ELSS), the rules around STCG vs LTCG, indexation, dividend tax, SIP holding periods, NRI status and loss offset all matter. By proactively understanding these aspects, you can avoid surprises, optimise your tax efficiency and keep more of what your investments earn.

So, are you ready to view your mutual fund investments through the lens of smart taxation?