The Provident Fund (PF) is a long-term savings scheme designed mainly for salaried employees to help them build a secure financial future after retirement. It works as a disciplined savings plan where a fixed portion of an employee’s salary is deducted every month and deposited into a PF account, along with an equal contribution from the employer. Over time, this amount grows with interest, creating a substantial retirement corpus.

In India, PF is managed by the Employees’ Provident Fund Organisation (EPFO) and comes in different forms such as EPF (Employees’ Provident Fund), PPF (Public Provident Fund), VPF (Voluntary Provident Fund), and GPF (General Provident Fund). Each type serves a different group of individuals, but all aim to promote long-term savings with safety and tax benefits.

One of the biggest advantages of PF is its tax-saving benefit under Section 80C, along with government-backed security and stable returns. PF also offers facilities like partial withdrawals, loans, and online account management. In this article, you’ll learn what PF is, how it works, the different types of PF, its key benefits, and why it plays an important role in long-term financial planning.

Table of Contents

What Is PF (Provident Fund)?

PF stands for Provident Fund, a long-term savings scheme regulated by the Government of India. Its main purpose is to help individuals accumulate a financial corpus over time, primarily for retirement, but also for major life needs like housing, education, or emergencies.

PF works on a straightforward principle:

- You contribute regularly

- The money earns interest

- The fund grows through compounding

- You withdraw it when required or at retirement

For salaried employees, PF is usually mandatory through EPF, while other forms like PPF and VPF are voluntary. What makes PF powerful is that it enforces saving automatically, something most people struggle to do on their own.

How Does Provident Fund Work? Step-by-Step Contribution Process

PF works silently but efficiently in the background.

- Monthly Contribution Begins

A fixed percentage of your salary is set aside every month. In the case of EPF, both employee and employer contribute. - Automatic Deduction

The PF amount is deducted directly from your salary, which means you save before you spend. - Employer’s Contribution

Your employer contributes an equal share (subject to rules), which effectively increases your savings without extra effort. - Interest Accrual

The PF balance earns interest annually at a rate declared by EPFO or the government. - Compounding Over Time

Interest earned also earns interest, which significantly boosts long-term growth. - Withdrawal or Transfer

You can withdraw PF at retirement or transfer it when changing jobs.

This structured process is why PF is often called a “forced savings tool”—and that’s exactly why it works so well.

Types of Provident Fund in India (EPF, PPF, VPF, GPF):

PF in India is not a single product. It comes in multiple forms designed for different categories of investors.

EPF (Employees’ Provident Fund)

- Mandatory for eligible salaried employees

- Employee and employer both contribute

- Managed by EPFO

- Ideal for long-term retirement planning

- Voluntary and open to all Indian residents

- Government-backed

- 15-year lock-in

- Popular among self-employed and conservative investors

VPF (Voluntary Provident Fund)

- Extension of EPF

- Allows employees to contribute more than the mandatory limit

- Earns the same interest as EPF

- Useful for aggressive retirement savers

GPF (General Provident Fund)

- Applicable to government employees

- Only employee contributes

- Lower complexity

Each type serves a different purpose, but all aim to build long-term financial security.

EPF vs PPF vs VPF: Key Differences Explained Simply

Understanding the difference helps investors choose wisely.

- EPF is best for salaried employees because of employer contribution.

- PPF suits self-employed individuals and long-term conservative investors.

- VPF is ideal for high-income earners who want to maximize retirement savings.

EPF and VPF grow faster due to employer contribution, while PPF offers unmatched tax efficiency and government backing.

PF Contribution Rate: Employee and Employer Share Explained

In EPF:

- Employee contributes 12% of basic salary + DA

- Employer contributes 12%, split between:

- EPF

- EPS (Employee Pension Scheme)

This shared contribution significantly increases long-term savings. For example, if you earn ₹30,000 basic salary, your PF contribution plus employer’s share can add up to thousands every year—without you actively saving more.

Benefits of Provident Fund (PF) for Salaried Individuals:

PF offers benefits that few other instruments combine in one place:

- Disciplined saving without effort

- Employer contribution = free money

- Low risk and stable returns

- Strong retirement planning tool

- Partial withdrawals for life needs

- Excellent tax efficiency

This is why financial planners often say PF should be the foundation of every salaried person’s investment portfolio.

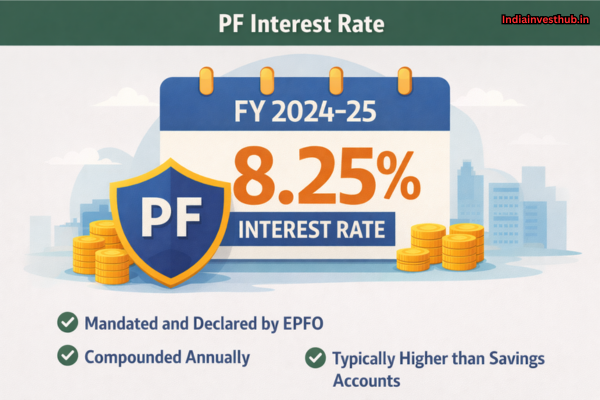

PF Interest Rate: How It Is Calculated and Credited

PF interest rates are declared annually. For EPF, EPFO announces the rate every year after government approval. Interest is:

- Calculated monthly on the closing balance

- Credited once a year at the end of the financial year

Historically, EPF interest rates have remained competitive compared to traditional fixed-income instruments (Source: EPFO notifications, Ministry of Labour).

PF Withdrawal Rules: Partial, Full Withdrawal & Lock-In Period

PF is designed for long-term use, but flexibility exists.

Partial Withdrawal:

Allowed for:

- Medical emergencies

- House purchase or construction

- Education or marriage

- Periods of unemployment

Full Withdrawal:

Permitted:

- At retirement

- After continuous unemployment (subject to rules)

Lock-In Period:

To enjoy full tax benefits, PF should ideally remain invested for at least 5 years.

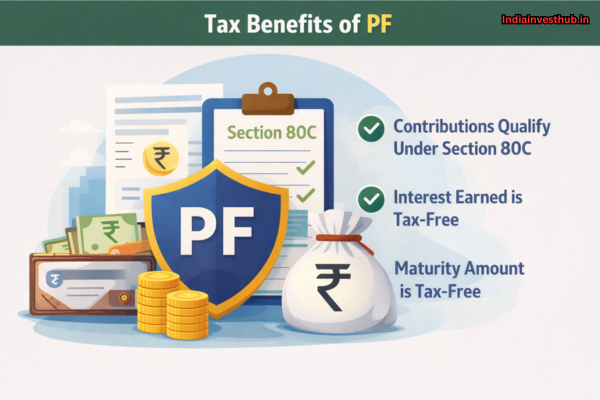

Tax Benefits of PF:

PF is one of the most tax-efficient investments in India.

- Employee contribution qualifies under Section 80C

- Interest earned is tax-free (within limits)

- Maturity amount is tax-free if conditions are met

This tax treatment makes PF superior to many fixed-income options like FD.

FAQs – PF (Provident Fund)

Q1: Is PF mandatory?

👉Yes, for eligible salaried employees under EPF rules.

Q2: Can PF be transferred when changing jobs?

👉Yes, PF can and should be transferred to avoid multiple accounts.

Q3: Is PF better than FD?

👉PF is better for long-term retirement planning, while FD suits short-term safety.

Q4: Can self-employed people invest in PF?

👉They cannot invest in EPF but can open a PPF account.

Q5: Is PF safe?

👉Yes, PF is government-regulated and considered very safe.

Conclusion:

PF is not just a salary deduction—it’s a powerful, long-term wealth and retirement planning tool that works quietly in the background. With automatic contributions, employer support, stable interest, and strong tax benefits, PF helps investors build financial security without constant decision-making. Whether you are just starting your career or already planning retirement, understanding PF allows you to use it strategically rather than ignoring it.

So before you treat PF as just another line on your payslip, ask yourself—are you truly using PF to its full potential to secure your financial future?