In March 2020, just as the world began grappling with a global pandemic, financial markets across the globe were hit with a jolt. Muthu, a retail investor from Tamilnadu, watched in disbelief as his portfolio plummeted by more than 25% within weeks. He had read about “corrections” but this seemed far worse. Was it a crash? Or just a sharp correction? Like millions of investors, Muthu was confused. If you’ve ever asked yourself the same question, you’re not alone.

Crashes can shake markets and test even the most seasoned investors. However, differentiating between a market correction and a market crash is crucial to making rational investment decisions. This article aims to demystify both concepts with facts, real examples, and actionable tips. Whether you’re a beginner or a regular investor, by the end of this guide from Indiainvesthub, you’ll have a clearer understanding of how to react during periods of volatility and uncertainty.

Table of Contents

What is a Market Correction?

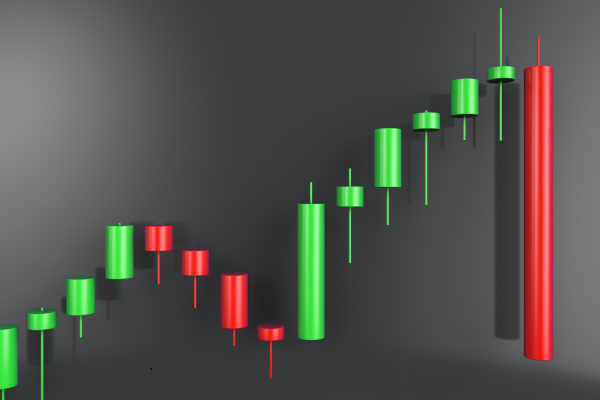

A market correction is typically defined as a decline of 10% to 20% in the price of a stock, index, or entire market from its recent high. Corrections are normal parts of a market cycle and often serve to “correct” overvalued prices.

Key Characteristics:

- Generally short-term, lasting weeks to a few months.

- Can occur in any asset class.

- Often triggered by investor concerns, geopolitical issues, interest rate hikes, or macroeconomic shifts.

Real Example:

In September 2021, the S&P 500 dropped by approximately 5% due to inflation concerns and the Evergrande crisis in China. Though sharp, it didn’t spiral into a crash. It was a textbook example of a market correction.

What is a Market Crash?

A market crash, on the other hand, is a sudden, drastic decline in the market, typically exceeding 20%, within days or weeks. Crashes are driven by panic selling and usually signal deeper economic concerns.

Key Characteristics:

- Abrupt and steep declines.

- Triggered by extreme fear or major negative news.

- Can take months or years for markets to recover.

Real Example:

The 2008 Global Financial Crisis saw the Sensex drop over 60% in a matter of months. In just a few days in October 2008, the index fell by more than 1,000 points multiple times. This was a classic market crash.

Key Differences Between Correction and Crash

| Feature | Market Correction | Market Crash |

|---|---|---|

| Price Decline | 10% to 20% | Over 20% (usually sudden) |

| Duration | Short-term | Short to long-term |

| Trigger | Valuation adjustment, news | Panic selling, economic collapse |

| Recovery Time | Weeks to months | Months to years |

| Emotional Impact | Mild concern | Panic, fear, widespread losses |

How to Identify a Correction vs Crash in Real-Time

1. Observe the Speed of Decline

Corrections occur gradually. Crashes happen almost overnight. If the market drops 10% in a single trading day, it’s likely a crash.

2. Analyze the Trigger Event

Is it based on earnings reports or temporary inflation? That’s a correction. Is it because of a systemic issue like a financial institution collapsing? That’s a crash.

3. Look at Volume and Sentiment

Crashes are accompanied by panic selling and record-breaking volumes. Corrections see moderate increases in volume and cautious behavior.

4. Follow Economic Indicators

Crashes tend to coincide with GDP contractions, rising unemployment, or housing market declines. Corrections are often market-specific, not economy-wide.

Statistics That Show the Nature of Market Volatility

- According to CNBC, the S&P 500 has experienced 27 market corrections since World War II. The average decline was 13.7%, and the market took about four months to recover.

- During the 2020 COVID-19 crash, global markets lost over $6 trillion in market value in less than a month.

- Indian markets have had five major crashes in the last 30 years, each followed by long-term rebounds, highlighting the cyclical nature of crashes.

Tips to Survive Market Volatility

1. Have a Long-Term Perspective

Corrections and crashes are temporary. Investing with a 5-10 year horizon can reduce emotional responses.

A diversified portfolio reduces risk. Include a mix of equities, debt, and international exposure.

3. Use Stop-Loss Wisely

Especially useful during crashes, setting a stop-loss can help minimize damage. Don’t overuse it during normal corrections.

4. Avoid Panic Selling

Reacting emotionally during a crash can lock in losses. Instead, focus on the fundamentals of your investments.

5. Regular Monitoring but No Overreaction

Check your portfolio regularly, but avoid daily emotional decisions based on news or short-term noise.

6. Take Advantage of Opportunities

Both corrections and crashes can present buying opportunities. Use SIPs or staggered investments to capitalize on lower valuations.

How Indiainvesthub Can Help

At Indiainvesthub, we understand the fear and confusion that comes with sudden market declines. Through simplified guides like this, we aim to empower everyday investors with the knowledge needed to make confident, informed decisions. Whether you’re preparing for a correction or managing the aftermath of a crash, our content helps you understand market behavior better.

Conclusion

Understanding the difference between market corrections and crashes is more than just a technical exercise; it’s an emotional and strategic necessity. By knowing what drives these market movements and how to identify them, investors can respond with calm and clarity instead of fear and confusion.

Corrections are part of healthy market cycles, while crashes often reflect deeper economic troubles. But both are survivable—with the right knowledge, tools, and mindset.

Are you prepared to stay calm and confident when the next market shock hits?