When it comes to investing in the stock market, finding safe high-yield stocks can be a game-changer for income-seeking investors. These stocks provide an attractive dividend yield, offering a steady stream of income while potentially growing your capital over time. However, balancing the appeal of high dividend yield with the inherent risks is key to making wise investment decisions. In this article, we will explore Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk, delving into strategies to secure returns while minimizing exposure to volatility and other pitfalls.

Why Free Cash Flow Matters More Than Earnings is essential in Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk because free cash flow reflects a company’s true ability to sustain dividend payouts over time.

Table of Contents

Understanding Dividend Yield

Before we dive into Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk, it’s crucial to grasp the basics of dividend yield. Dividend yield is a ratio that shows how much a company pays out in dividends each year relative to its stock price. This measure helps investors determine how much income they can expect from their investments.

The formula is simple:

Dividend Yield = (Annual Dividends per Share / Price per Share) x 100

For example, if a company pays $5 in annual dividends and its stock is priced at $100, the dividend yield would be 5%. Dividend yield serves as an important criterion for income investors, but Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk means not just looking for high numbers but finding reliable, stable stocks.

The Appeal of High-Yield Stocks

High-yield stocks can be tempting, especially in times of low interest rates, where other income-generating investments like bonds may offer limited returns. Investors drawn to Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk often see these stocks as a way to earn passive income, but it’s essential to examine the underlying fundamentals of a company.

A high dividend yield can sometimes signal trouble. For instance, if a company’s stock price is plummeting while it maintains a high dividend payout, the dividend yield may appear disproportionately high. This is why Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk involves careful analysis beyond just the yield percentage.

Risk Factors in High-Yield Stocks

When it comes to Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk, it’s important to understand the associated risks. A high dividend yield may not always indicate a good investment. Several risk factors could threaten the stability of these dividends:

- Dividend Sustainability: High-yield stocks might not be able to sustain their dividends long-term. Companies may cut dividends when earnings shrink or cash flow becomes constrained, leading to a drop in stock price and a reduction in your income.

- Financial Health: A company offering high dividends may be using unsustainable business practices to maintain its payouts. If the company is taking on debt to pay dividends, this could be a red flag.

- Industry-Specific Risks: Certain sectors, such as utilities or real estate investment trusts (REITs), are known for paying high dividends. However, they can also be more sensitive to regulatory changes, interest rates, or economic cycles.

- Inflation and Interest Rates: High-yield stocks may suffer if interest rates rise, as fixed-income investments like bonds become more attractive. In the case of inflation, companies may struggle to maintain high dividend payouts.

By keeping these risks in mind, Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk requires evaluating the overall stability and prospects of the company and sector in which you’re investing.

Key Metrics for Finding Safe High-Yield Stocks

Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk necessitates understanding the financial health of a company. Here are a few critical metrics to assess:

- Payout Ratio: The payout ratio compares the dividends a company pays to its earnings. A lower payout ratio (below 60%) is generally seen as more sustainable, as it means the company retains enough earnings to cover dividends without jeopardizing growth.

- Free Cash Flow (FCF): Free cash flow is the cash a company has after covering operating expenses and capital expenditures. Positive and growing FCF indicates the company has enough liquidity to sustain or increase dividends.

- Dividend Growth History: Companies with a history of steadily increasing dividends over time demonstrate strong financial management and resilience. These “dividend aristocrats” are often favorites among income investors who are Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk.

- Debt Levels: High debt levels can limit a company’s ability to pay dividends, especially if earnings are inconsistent. A low debt-to-equity ratio is a sign of financial stability.

- Earnings Per Share (EPS) Growth: A growing EPS indicates that the company is profitable and has the ability to sustain its dividend payments.

Sectors Offering High-Yield Stocks

When Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk, it helps to focus on sectors known for consistent dividend payments:

- Utilities: Utility companies provide essential services like water, electricity, and gas, which makes their earnings more stable. These companies often offer high, reliable dividends.

- Telecommunications: Telecom companies tend to have high yields due to their stable, recurring revenue from subscription services.

- Real Estate Investment Trusts (REITs): REITs must pay out 90% of their taxable income as dividends to shareholders, making them popular for income-seeking investors.

- Consumer Staples: Companies that produce essential goods, such as food and household products, often offer stable dividends because demand for their products remains constant regardless of the economic environment.

While these sectors can offer stability, Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk still requires you to scrutinize individual companies’ financials.

Diversification: Mitigating Risk in High-Yield Investing

Diversification is a key strategy for Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk. Instead of relying on a few high-yield stocks, spread your investments across different sectors and companies. This reduces the impact of any one stock cutting its dividend or experiencing a price drop.

Additionally, consider blending high-yield stocks with growth stocks that may not offer high dividends but have strong potential for capital appreciation. This balanced approach helps mitigate the risk of focusing too heavily on yield.

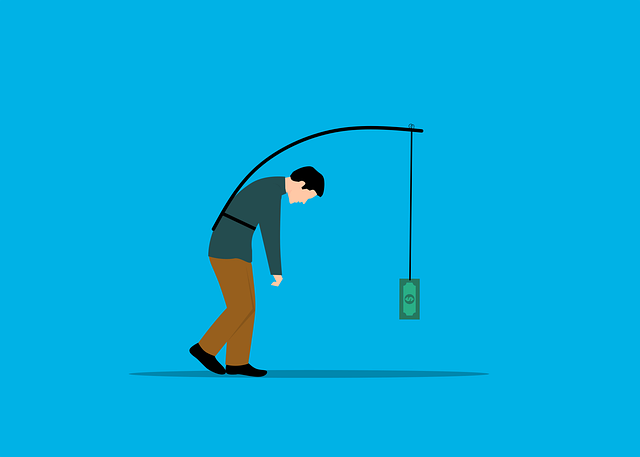

Avoiding Yield Traps

A common mistake when Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk is falling into a “yield trap.” A yield trap occurs when investors are drawn to a stock purely because of its high dividend yield, without considering the sustainability of the dividend. If a company cuts its dividend, the stock price will likely drop, leading to losses.

To avoid yield traps, focus on companies with strong fundamentals, reasonable payout ratios, and healthy cash flow. Look for firms that have demonstrated consistent earnings growth and a commitment to returning value to shareholders through dividends.

Balancing Dividend Yield with Total Return

While Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk is important, it’s also essential to consider the total return on your investment. Total return combines dividend income with capital gains (or losses) from the stock’s price movement.

Sometimes, a lower-yielding stock may offer better overall returns through price appreciation. Therefore, it’s critical to strike a balance between dividend yield and the potential for long-term capital growth.

Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk is a vital skill for income investors looking to secure a steady stream of dividends without exposing themselves to excessive risks. By focusing on key financial metrics, diversifying across sectors, and avoiding yield traps, you can achieve a balance that allows you to enjoy both income and growth from your portfolio.

Investing in high-yield stocks can be lucrative, but it requires due diligence. Remember, the goal is not just to find stocks with high yields but to identify those that offer both safety and the potential for long-term stability. In this way, Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk becomes a cornerstone of a sound investment strategy, helping you generate income while protecting your capital.

In conclusion, Finding Safe High-Yield Stocks: Balancing Dividend Yield with Risk isn’t just about finding the highest yields but ensuring that the dividends are sustainable, the company is financially healthy, and the overall investment aligns with your long-term financial goals. With the right approach, you can build a portfolio that offers both high income and capital preservation.